Happy Monday!

I hope you had an amazing weekend.

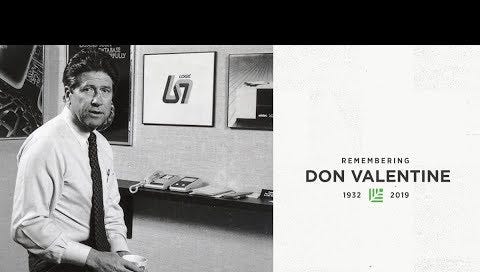

Allow me to give a brief about Don Valentine before I share 1 interesting story, 2 quotes to think about and 3 short lessons from him for you to read this week.

I learnt about him recently when he passed away, Don Valentine is referred to as the "Grandfather of Silicon Valley venture capital.

In 1972, Valentine founded venture capital firm Sequoia Capital. Sequoia was one of the original investors of Apple Computer and Atari after Valentine met Steve Jobs when he was a line engineer for Atari, and in 1978, Sequoia invested $150,000 in Apple. He played a key role in the formation of many industries such as semiconductors, personal computers, personal computer software, digital entertainment and networking. He was also one of the early investors for Oracle, Cisco, Electronic Arts, Google, YouTube and many others.

1 STORY FOR YOU

How and Why Don put money into Apple & Steve.

A lot of people wouldn't invest in Apple, wouldn't even talk to Apple, because Steve was so odd. Well, Steve was the son of Nolan Bushnell. (Founder of Atari)

Not literally, but he evolved the same way, and Apple was in many ways an evolution of Atari. A lot of Steve's original thinking came from Nolan.

Steve worked at Atari as a technician. He was maybe 18, and I got to know him slightly. Atari was a small company — you knew almost everybody that was involved technically. And Nolan's fine-touch hand was a very important part of that embryonic process of cultivating Steve’s thinking and concentration. More, I believe, than people realize.

So when they started Apple, Steve went to Nolan and said, "I'm going to start this company. I will sell you a third of it for $50,000." Which demonstrated that Steve had no concept of what things cost. Nolan said he was tempted, but he said no.

So Steve asked, "How do you raise money?" And Nolan said, "Don't ask me, call Don."

And we began talking more offline, Steve and I, about the formation of a “personal computer” company — words that might have been coined three days earlier. We didn't have personal computers then.

The closest thing to a personal computer in those days was a product from DEC — Digital Equipment Corporation. It cost $250,000 and it was a fine mini-computer, but there wasn't a soul in North America who was going to buy a personal computer for $250,000.

So Steve came over, and we had a serious conversation.

Now Steve in those days — my physical image of him was like Ho Chi Minh. He was always either a fruitarian or a vegetarian and did a number of weird things, but I think a lot of that was on purpose just to shock people.

He was another guy who went to school for a year. There's a pattern of people in the early days of Silicon Valley, in the early days of startup companies, who had an idea they thought was more important than three more years of going to school.

As a result, many people wouldn’t talk to Steve when he was raising money. It's amazing, the destructive aspects of ego-driven decisions. People who think, “The right people don't dress like that, don't have haircuts like his, don’t go to that school or this one.”

But you have to listen to everyone. One of the things I always advocated here is learning to listen. Learning to ask questions.

And so we backed Apple based on getting a product to market that was a consumer-aimed product, and that cost very little in comparison to what computers were thought to cost, and in 1977 that’s what they did.

I have only met and known two visionaries in my life. Lots of people in Silicon Valley think they're visionaries. Bob Noyce was one, at Fairchild Semiconductor. Steve was the other.

2 QUOTES FROM HIM

The art of storytelling is incredibly important. Learning to tell a story is critically important because that’s how the money works. The money flows as a function of the story.

When we have a successful investment the pronoun is ‘we’, when we have a very unsuccessful investment the pronoun is ‘we’.

3 LEARNINGS FOR YOU

It’s a storyteller’s world

When you are in a business driven by optionality, like the venture capital business, investing a lot of resources in creating spreadsheets is a waste of time since the assumptions in it are guesses. The best way to quantify the opportunity is actually with a story.

Chris Sacca puts it this way: “Good stories always beat good spreadsheets. Before drawing a single slide of your pitch deck, tell the story out loud to anyone who will listen. Again and again. Now you have your deck.”

Telling stories is like public speaking: the more you do it, the better you get. If you must refer to notes in telling your story, it will be vastly less effective.

Target Big Markets

“We have always focused on the market — the size of the market, dynamics of the market, nature of the competition because their objective was to always to build big companies, if you don’t attack big markets it’s highly unlikely that you will build a big business.”

Don Valentine is saying that even a subpar management team can win in a market that is really big that is exploited early. And, of course, a first-rate management team in that same situation will do even better.

Credentials are not that important

“We don’t spend a lot of time wondering about where people went to school, how smart they are and all the rest of that. We’re interested in their idea about the market they’re after, the magnitude of the problem they’re solving, and what can happen if the combination of Sequoia and the individuals are correct.”

One of the most attractive things about the venture capital world is that someone without credential X or Y can still become a success. That is not to say that credentials are not relevant or helpful, especially early in a person’s career, but history has shown that at least they are not required. One of the very best credentials, of course, is previously scoring a very big financial return, most importantly for the person considering your proposal.

If you have subscribed recently then you should check out my previous newsletters where I wrote about Richard Feynman, Ed Catmull, Patrick Collison, Dr Edwin Land

That’s it from me, until next Monday!

Would love to know if you have any feedback or want me to write about someone who you think is amazing at what they do! Please share it with your friends so everyone can grow together.